capital gains tax increase retroactive

This tax had some of the features of the gift tax which was abolished at the same time. The first and easiest way to lower your capital gains burden is to take advantage of the capital gains tax exemption.

Retroactive Tax Legislation And Gift Planning In 2021 New Jersey Law Journal

116-94 retroactively repealed the section 512a7 which required exempt organizations to increase their unrelated business taxable income for expenses incurred to provide certain benefits including qualified transportation fringes.

. Abolished inheritance tax in 1972. As of January 1 2021 Proposition EE increased the cigarette tax from 084 to 194 per pack set a minimum after-tax retail price for cigarettes at 700 per pack increased the tax on other tobacco products from 40 percent to 50 percent of wholesale value created a new tax on nicotine products at 30 percent of wholesale value and. State tax statutes forms and instructions.

This is great news if your house hasnt appreciated more than. Retroactive repeal of section 512a7. Although earnings grow on a tax-deferred basis if a policyholder withdraws funds before they reach the age of 59½ any investment gains would be subject to.

The Capital Gains Tax Exemption. 208 surcharge are combined. For singles the current exemption is 250000.

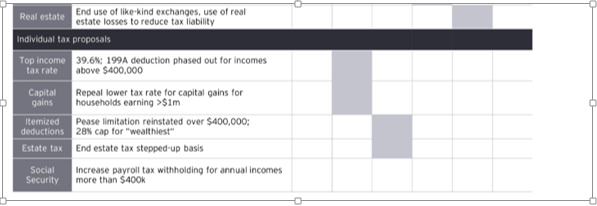

The first change adopted as part of SB 1827 which is effective retroactive to January 1 2021 is the creation of a cap to prevent the combined top marginal tax rate from exceeding 45 percent when the general rates and the Prop. Abolished estate duty in 2006 for all deaths occurring on or after 11 February 2006. Gains and losses from disposition of property.

That means that the tax wont apply to the first 250000 of your capital gains. However capital gains are 50 taxable and added to all other income of the deceased on their final return.

To Sell Or Not To Sell Biden To Propose Doubling The Capital Gains Tax Withum

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times

Surging M A Surpasses Expectations White Case Llp Jdsupra

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

President Joe Biden S Capital Gains Tax Hike Plan Could Legally Become Retroactive Youtube

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

House Ways And Means Releases Reconciliation Tax Payfors

Proposed Changes To U S Section 1202 Tax Reform What You Need To Know

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

Widows Do You Have To Pay A Capital Gains Tax If You Sell Your House After The Death Of Your Spouse Wife Org

Washington Enacts Individual Capital Gains Tax Grant Thornton

Estate Planning In A Biden Administration Denha Associates Pllc

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

History And Retroactive Capital Gains Rate Changes

Coats Rose Possible Biden Tax Changes

President Joe Biden S Capital Gains Tax Hike Plan Could Legally Become Retroactive Youtube

Table Of Experts Tax Outlook For 2021 San Antonio Business Journal